The Gulf Cooperation Council region has emerged as one of the world’s most dynamic markets for business mobility solutions. While leisure tourism often dominates headlines about car rental in Dubai, Abu Dhabi, and Riyadh, a quieter revolution is transforming how corporations approach transportation. The B2B segment, encompassing corporate car rental, long-term leasing, and comprehensive fleet management services, is experiencing unprecedented growth as regional businesses seek asset-light strategies and operational flexibility.

Market Overview: A Region in Transition

The GCC car rental market reached approximately USD 5.6 billion in 2024 and is projected to grow at a compound annual growth rate of 13.8% through 2032, potentially reaching USD 15.75 billion. Within this expanding market, the corporate segment represents a particularly dynamic growth area. The United Arab Emirates currently leads the regional market with approximately 40% market share, while Saudi Arabia is projected to record the fastest growth at 7.71% CAGR through 2030.

What makes the GCC distinctive is the structural shift occurring beneath these headline figures. While short-term rentals accounted for approximately 71% of market share in 2024, long-term and operating leases are growing faster, advancing at 7.75% CAGR. This acceleration reflects a fundamental change in how regional corporations view vehicle assets: increasingly as services to be consumed rather than capital to be owned.

The UAE car rental, leasing, and limousine market alone reached USD 4.2 billion in 2024, driven by a growing corporate ecosystem and sustained tourism. Dubai welcomed 9.31 million international overnight visitors in the first half of 2024, a 9% increase over the previous year, but corporate travel and the expanding expatriate workforce contribute equally to sustained demand.

The Economics of Corporate Leasing

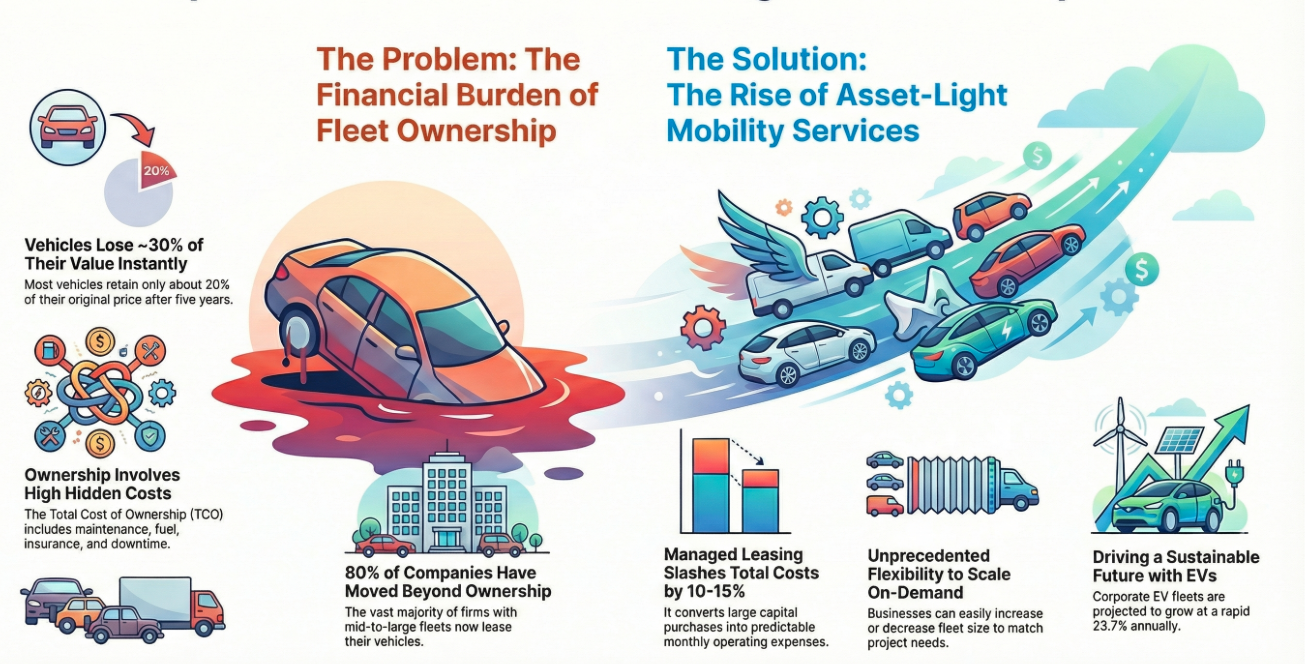

The decision between leasing and purchasing fleet vehicles represents one of the most consequential financial choices facing corporate decision-makers. According to industry data, approximately 80% of companies with mid-to-large size fleets now lease their vehicles, while only 20% exclusively own their vehicles. This preference reflects several compelling economic advantages.

Total Cost of Ownership Considerations

When evaluating fleet acquisition strategies, sophisticated corporate buyers examine Total Cost of Ownership rather than simple purchase price. TCO encompasses acquisition costs, administrative and operating expenses, maintenance, fuel, insurance, depreciation, and downtime costs. The formula commonly applied is:

TCO = Acquisition Costs + Administrative/Operating Costs + Maintenance Costs + Fuel Costs + Depreciation Costs + Downtime Costs

Research indicates that vehicles typically lose approximately 30% of their value shortly after purchase, with most retaining only about 20% of their original purchase price after five to six years. For corporations, this depreciation represents capital trapped in declining assets. Leasing transfers this depreciation risk to the lessor, freeing corporate balance sheets for core business investments.

Companies implementing managed fleet leasing programs have reported reductions in total cost of ownership averaging 10-15% compared to ownership models. One documented case study showed a consumer goods company restricted by annual capital expenditure budgets was able to replace three-quarters of its fleet through leasing while reducing monthly maintenance spend by 58%.

Cash Flow and Balance Sheet Benefits

Leasing fundamentally restructures how fleet costs flow through corporate finances. Monthly lease payments convert large capital expenditures into predictable operating expenses, improving cash flow management and financial forecasting. Under operating lease arrangements, companies can obtain tax benefits by deducting 100% of lease payments from income statements.

For smaller and medium-sized enterprises particularly, leasing eliminates the substantial upfront capital required for vehicle acquisition. This capital preservation allows businesses to maintain credit lines and borrowing capacity for strategic investments rather than tying resources to depreciating transportation assets.

Corporate Rental Models in the GCC

The regional corporate rental market has evolved to offer increasingly sophisticated service models tailored to diverse business requirements.

Short-Term Corporate Rental

Major car rental operators maintain dedicated corporate divisions providing streamlined booking processes, consolidated billing, and negotiated rates. Corporate accounts typically include priority service, dedicated account managers, and customized reporting for expense management. This model serves companies requiring vehicles for visiting executives, client entertainment, project-based needs, or temporary workforce expansion.

The proliferation of platform-based operators has compressed customer acquisition costs across the region, enabling dynamic pricing that benefits corporate clients booking during off-peak periods while ensuring fleet utilization remains high for operators.

Long-Term Operating Leases

Long-term leases, typically ranging from twelve months to several years, have emerged as the preferred model for companies requiring consistent fleet access without capital commitment. These arrangements often bundle maintenance packages, insurance, and vehicle replacement services into predictable monthly payments.

Regional corporations and project contractors increasingly favor contracts that can be upsized or downsized as headcount fluctuates. This flexibility proves particularly valuable in the GCC’s project-driven economy, where construction, real estate development, and hospitality ventures create variable transportation demands.

The subscription model has gained particular traction, with companies like IndyGo raising USD 1.9 million to extend all-inclusive packages across Saudi Arabia and the UAE. These services offer flexibility beyond traditional leasing, allowing businesses to adjust fleet composition monthly based on operational requirements.

Full-Service Fleet Management

For larger organizations, comprehensive fleet management services provide end-to-end solutions spanning vehicle acquisition, maintenance scheduling, fuel management, telematics integration, and disposal. The Europe, Middle East and Africa fleet management market was valued at USD 10.09 billion in 2024 and is expected to reach USD 21.64 billion by 2032, growing at 10% CAGR.

Fleet management services increasingly incorporate sophisticated technology platforms. GPS tracking devices, dash cameras, and data loggers provide real-time visibility into fleet operations. Predictive maintenance powered by artificial intelligence identifies potential issues before failures occur, reducing downtime and operating costs. Machine learning algorithms support dynamic routing and fuel optimization, with some implementations achieving 20-30% reductions in energy consumption.

The Executive and Chauffeur Services Segment

The GCC’s distinctive business culture, with its emphasis on hospitality and corporate representation, has created substantial demand for premium chauffeur services. According to industry sources, the UAE’s luxury transport market has grown by more than 40% in recent years, driven by executive travelers, corporate delegations, and discerning business tourists.

Corporate chauffeur services address specific business requirements that self-drive rentals cannot satisfy. Executives traveling between meetings can work en route rather than navigating unfamiliar roads. VIP client arrivals require professional hospitality from airport to destination. Corporate events and roadshows demand coordinated transportation logistics for multiple participants.

The chauffeur segment features premium vehicle fleets ranging from Mercedes-Benz S-Class and BMW 7 Series sedans to executive SUVs like Range Rover Vogue and Cadillac Escalade. For larger groups, Mercedes-Benz V-Class vans and luxury Sprinters provide mobile meeting environments. Professional chauffeurs undergo training in business etiquette, confidentiality protocols, and regional geography.

Corporate chauffeur programs offer predictable pricing structures covering vehicle, driver, fuel, tolls, and parking without hidden fees. Monthly and weekly programs serve companies requiring consistent executive transportation, while hourly arrangements accommodate variable scheduling requirements.

Industry Sectors Driving B2B Demand

Several industry verticals demonstrate particularly strong demand for corporate rental and fleet management services in the GCC.

Construction and Real Estate Development

The region’s massive infrastructure projects and real estate developments require extensive fleet support. Construction companies utilize vehicles ranging from passenger cars for site management to SUVs capable of navigating development areas. Long-term leases with flexible scaling align vehicle availability with project phases, while fleet management services ensure maintenance compliance across distributed operations.

Hospitality and Tourism

Hotels, resorts, and tourism operators require diverse vehicle fleets for guest transfers, airport pickups, and excursion services. The unpredictable nature of tourism demand makes leasing particularly attractive, allowing properties to scale transportation capacity during peak seasons without maintaining underutilized assets during quiet periods.

Energy and Industrial Services

Oil and gas operations, petrochemical facilities, and industrial service providers maintain substantial vehicle fleets for personnel transportation and field operations. The remote locations of many facilities demand reliable vehicles and comprehensive maintenance support, making managed fleet services valuable for operational continuity.

Corporate and Professional Services

Financial institutions, consulting firms, and professional services organizations utilize corporate rental for visiting partners, client meetings, and employee transportation. The image conveyed by vehicle selection matters in client-facing roles, making premium vehicle access through rental more practical than ownership for firms requiring varied vehicle types.

The Sustainability Imperative

Environmental, Social, and Governance considerations increasingly influence corporate fleet decisions. As corporate sustainability reports spotlight fleet emissions, businesses face pressure to demonstrate progress toward carbon reduction targets.

The GCC electric vehicle market is experiencing rapid growth, with the UAE contributing 42% of regional market share in 2024. While private buyers represented approximately 63% of EV purchases in 2024, corporate fleets are projected to scale fastest at 23.73% CAGR through 2030. Government initiatives support this transition: the UAE aims for at least 10% of all vehicles on the road to be EVs by 2030, while Saudi Arabia’s Riyadh targets 30% electric vehicle penetration by the same year.

For fleet operators, EV integration presents both opportunities and complexities. Electric vehicles typically have higher upfront acquisition costs but lower total cost of ownership over the vehicle’s lifecycle due to reduced fuel costs, lower maintenance expenses, and potential government incentives. However, TCO calculations must account for charging infrastructure investment, battery degradation considerations, and operational patterns since EVs perform optimally on predictable routes.

The Dubai Green Mobility Strategy 2030 aims to place approximately 42,000 electric vehicles on city roads, supported by over 700 operational charging stations. NEOM, Saudi Arabia’s ambitious smart city project, targets 100% electric vehicle adoption by 2030 with more than 4,000 charging stations planned.

Rental and fleet management companies are responding by introducing low-emission vehicles to their portfolios. Route optimization programs and driver training initiatives reduce fuel consumption and carbon emissions even for conventional vehicle fleets. For companies pursuing ESG reporting requirements, sustainable fleet practices enhance corporate reputation while meeting regulatory compliance.

Technology Transformation

Digital transformation is reshaping every aspect of B2B car rental and fleet management. Mobile booking applications now capture the majority of transaction value, with seamless e-KYC verification, digital key handovers, and AI-driven damage assessment reducing pickup times and branch overheads.

Telematics Integration

Real-time data feeds enable predictive maintenance scheduling, cutting unexpected downtime and safeguarding operational continuity. Telematics systems track vehicle location and performance while analyzing driver behavior, fuel consumption, and maintenance needs. This data-driven approach enables fleet managers to optimize routes, benchmark performance, and identify inefficiencies.

Advanced analytics predict demand patterns influenced by tourism seasons, business travel cycles, and major regional events, allowing operators to optimize vehicle availability and pricing. Insurance premiums increasingly reflect telematics data, rewarding fleets demonstrating safe driving behaviors with preferential rates.

Platform Integration

Corporate clients increasingly expect integration between rental platforms and their enterprise systems. Travel management integration allows seamless booking within corporate travel policies. Expense management connections automate cost allocation and reporting. API connectivity enables custom workflow integration for organizations with specific operational requirements.

Regulatory Environment

The GCC regulatory landscape continues evolving to support market growth while ensuring consumer protection and service standards. Saudi Arabia’s Ministry of Transport has codified rules for leasing brokers, enabling market scale. UAE authorities have simplified cross-border mobility by recognizing GCC licenses, enlarging the addressable customer pool for corporate rentals.

Insurance requirements represent a significant regulatory consideration. UAE motor premiums climbed 40% in 2024, with rental vehicle coverage increasing from 2% to 8.5% of asset value. Expatriates often face additional surcharges due to limited local driving histories, affecting corporate rental costs for organizations with international workforces.

Fragmented regulatory rules across emirates and kingdoms require operators to maintain separate compliance regimes for each jurisdiction. Differences extend to emirate level within the UAE and persist across Saudi Arabia, Qatar, Oman, and Bahrain, complicating fleet allocation for companies operating across multiple markets.

Перспективы будущего

The B2B car rental and fleet management sector in the GCC stands at an inflection point. Several structural trends will shape market evolution through the coming decade.

Continued Shift to Asset-Light Models

Corporate preference for operating expenditure over capital expenditure will continue driving leasing growth. The flexibility to scale fleet size based on business conditions, combined with TCO advantages and balance sheet benefits, makes leasing increasingly attractive across company sizes and industry sectors.

Electrification Acceleration

Government sustainability mandates and corporate ESG commitments will accelerate electric vehicle integration into corporate fleets. Fleet management systems will increasingly incorporate battery health monitoring, charging optimization, and range prediction capabilities. The development of fast-charging infrastructure along major GCC corridors will address range anxiety concerns that currently limit EV adoption for certain corporate applications.

Consolidation and Specialization

The market may see consolidation among operators seeking scale economies in procurement, technology investment, and geographic coverage. Simultaneously, specialist providers may emerge focusing on specific industry verticals, vehicle categories, or service models where deep expertise creates competitive advantage.

Technology Integration Deepening

Artificial intelligence and machine learning will become more sophisticated, reducing false maintenance alerts and providing deeper insights into fleet performance and risk patterns. Autonomous vehicle pilots, already underway in Abu Dhabi, hint at future structural changes that could fundamentally reshape corporate transportation.

Conclusion

The B2B car rental market in the GCC represents a substantial and growing opportunity shaped by regional economic diversification, changing corporate financial preferences, and technological advancement. For businesses operating in the region, understanding the evolving landscape of corporate leasing, fleet management, and executive transportation services enables more strategic approaches to business mobility.

The shift from asset ownership to mobility services reflects broader trends in corporate operations worldwide, but the GCC’s unique combination of economic dynamism, infrastructure investment, and regulatory modernization creates particularly favorable conditions for B2B rental market growth. Organizations that develop sophisticated approaches to fleet strategy, balancing cost optimization with operational flexibility and sustainability requirements, will be better positioned to compete in the region’s rapidly evolving business environment.